CWS Annual Partners Meeting

The CWS Annual Partners Meeting provides an opportunity for you to learn about our apartment markets, investment strategies, along with our view on the economy, interest rates, and our outlook going forward.

2024 Annual Partners Meeting – April 2, 2024

To view recordings of the presentations, please click the links below to access the videos:

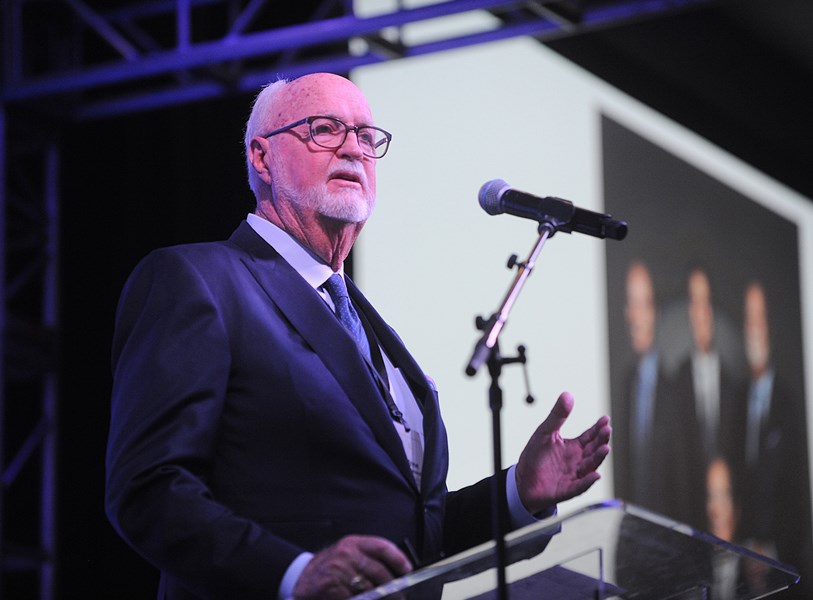

Gary Carmell: https://youtu.be/yc4kUZxgmjE

Mike Engels: https://youtu.be/cbSu6w-LbLY

Meeting Summary

The meeting began with Gary Carmell welcoming investors and guests in celebrating the 55th year of CWS hosting its Annual Partner Meeting. Gary started his presentation by describing the theme for this year which is “The Real Normal.” The word “real” is a play on real interest rates and how we are seeing a reversion back to the rate environment experienced prior to the period from late 2008 to March 2020. Since the onset of Covid in 2020, the apartment market has gone from undersupplied to oversupplied. As the Fed raised interest rates to fight inflation, the cost of debt increased dramatically for properties having variable-rate debt. Gary explained the curse of joint probabilities and how specific assumptions would require everything to go right to achieve success and how leverage can exacerbate investment value declines. Real estate values overall have declined on properties purchased in 2021

and 2022 and apartments were not immune. CWS acquired apartments in 2021 and 2022 at a slower pace than other operators who may have gone all in during the peak.

Currently, there appears to be a funding gap of approximately $50 billion in which apartment loans are greater than what borrowers can qualify today for new financing, which we believe will present opportunities for well capitalized buyers. Housing starts and building permits for multifamily apartments are down significantly, which should provide a recovery for apartments around 2026 as less new supply hits the market. CWS’s strategy is to stay on the playing field and recapture lost value on our late cycle investments, move early on 2025 loan maturities when necessary, and capitalize on stresses caused by the funding gap.

Mike Engels presented a performance overview on CWS’s 91 same-store properties from 2021 to 2023. Over the two-year period, net operating income was up 10% as rent revenue increased with higher rents and operating expenses increased mainly due to higher payroll and insurance costs. Interest payments went up dramatically as those properties with variable-rate loans had increased debt service payments and rate cap costs. The net result in operating cash flow declined by approximately 89%. Mike provided updates on capital call/lender group funding and discussed the potential for additional capital needs along with the status of upcoming loan maturities and refinances. As we look further ahead, we expect the market to show continued tough conditions over the next 24 months as additional supply hits the market before eventually being undersupplied. We are focused on revenue maximization and expense control and expect continued distribution suspensions through 2025 and anticipate further distribution reductions at many properties that are currently distributing. We believe there will be buying opportunities in the market due to high interest rates and competing supply pushing values down which have discounted many high quality assets. We project to have better supply/demand fundamentals in 2026 and beyond. Mike acknowledged the CWS teams which are all committed to getting our portfolio values and distributions pointed in the right direction. And lastly, he thanked our investors for their patience during this difficult period.

Steve Sherwood reiterated that the apartment business is a great long-term investment. New construction has slowed down dramatically due to the required returns from developers not being high enough to justify building, but there is a large wave of supply being delivered this year and next year. The interest cost to own a home has doubled for most new homeowners due to the higher interest rate environment. The premium for homeownership versus renting remains at an all-time high. Peak apartment valuations in 2022 coincided with peak development starts because of the large profit that could be had for new construction building. As rents and valuations have dropped, developers can no longer justify the risk-reward for new construction which will cause the supply pipeline to dry up. Another reason to be bullish on apartments is the increase in renter pool as the average age to own a home has risen from 37 to 41 which is approximately a 25% increase based on the starting renting age of 20. In summary, CWS will need to compete in this competitive market as the market absorbs the bulk of supply being delivered this year. Construction has dropped dramatically and we should see a positive change in rents once demand outstrips supply, which we think should happen in 2026. Investing when the prices are low takes courage and is a strategy we plan to implement. Steve took a moment to share a heartfelt recognition of his long-time co-founder and partner of 45 years, Bill Williams. He concluded by thanking our investors for their trust and patience all these years and especially in these challenging times.

➤ Disclosure :

Note the views and statements expressed by the presenters are of the their own opinion and not necessarily indicative of the company's views.

The property pictures featured throughout this website have already been capitalized by CWS investors and are not available for investment. Past performance is no guarantee of future results.

This website is provided to you by CWS Capital Partners. CWS Capital Partners provides investment advice to its proprietary funds. Through its affiliate CWS Apartment Homes it offers real estate related advice. Investment opportunities may be in the form of a single property offering or a pooled investment vehicle and are through an affiliated entity, CWS Investments. CWS Investments is a registered broker dealer, member FINRA SIPC. The information on this website is not intended to be investment advice or an offer; offers can only be made with the private placement memorandum and offering documents.

Private placement real estate securities offerings are speculative and involve substantial risks. Risks may include, but are not limited to, illiquidity, lack of diversification, loss of capital, default risk, environmental, development, and capital call risk. Investments may not achieve their objectives as outlined in their business plans.

For more information about CWS Capital Partners see its Form ADV. For information about CWS Investments see its Form CRS and FINRA Broker Check .